Learn about the Barclays Bank affiliate program.

Barclays Bank is a British multinational investment bank and financial services company headquartered in London, UK. The company operates in more than 40 countries around the world, offering a wide range of financial services to individuals, businesses, and corporations.

Founded in 1690, Barclays has a long and storied history. The company began as a goldsmith banking business, and over the years, it has grown into one of the largest financial institutions in the world. Today, Barclays is one of the “Big Four” banks in the UK, along with Lloyds Banking Group, Royal Bank of Scotland, and HSBC.

Barclays is a full-service bank, offering a range of services to its clients. These services include personal banking, business banking, investment banking, and wealth management. The company also operates Barclaycard, a credit card and payment services provider.

Personal banking services provided by Barclays include current accounts, savings accounts, mortgages, loans, and credit cards. The company also offers a range of insurance products, including home insurance, car insurance, and travel insurance. In addition, Barclays provides online and mobile banking services to allow its customers to manage their finances from anywhere in the world.

Barclays also offers a range of services to businesses of all sizes. These services include business accounts, loans, overdrafts, and credit cards. The company also provides cash management services, foreign exchange services, and trade finance services to help businesses manage their finances and expand their operations globally.

In the investment banking space, Barclays provides a range of services to corporations, governments, and institutional investors. These services include M&A advisory, equity and debt capital markets, and risk management solutions. The company also has a strong presence in the fixed income and foreign exchange markets.

Barclays is also a major player in the wealth management space. The company provides a range of investment management services, including discretionary portfolio management, advisory services, and wealth planning. Barclays’ wealth management services are aimed at high-net-worth individuals, family offices, and institutions.

One of the defining characteristics of Barclays Bank is its commitment to innovation. The company has been at the forefront of digital banking for many years, and it has invested heavily in developing new technologies to improve the customer experience. In recent years, Barclays has launched a range of innovative products and services, including a mobile banking app, a personal financial management tool, and a digital investment platform.

Barclays Bank has also been a pioneer in the field of sustainable finance. The company has set ambitious sustainability targets, including a commitment to becoming a net-zero carbon organization by 2050. Barclays has also launched a range of sustainable finance products, including green bonds and sustainability-linked loans, to help its clients transition to a low-carbon economy.

Despite its many strengths, Barclays has faced its fair share of challenges over the years. In 2012, the company was fined £290 million by UK and US regulators for manipulating Libor, a key benchmark interest rate. In 2018, Barclays’ CEO, Jes Staley, was fined £642,430 by UK regulators for his role in attempting to identify a whistleblower who had raised concerns about the bank’s conduct.

In recent years, Barclays has faced increased competition from challenger banks and fintech startups. These companies have disrupted the traditional banking industry with innovative products and services, and they have forced established players like Barclays to adapt and evolve to remain competitive.

Barclays Bank remains one of the largest and most respected financial institutions in the world. With a rich history, a commitment to innovation, and a strong focus on sustainability, Barclays is well-positioned to continue to grow and succeed in the years to come.

Did you know that Barclays Bank has an affiliate program?

Here is some basic information about what Barclays Bank is all about. Check it out, and if you are interested there is a link below to access the Barclays Bank affiliate program.

Personal banking, Barclays – From current accounts, mortgages and insurance, to loans, credit cards and saving accounts – see how we can help you. Let’s go forward

Miles Anthony Smith

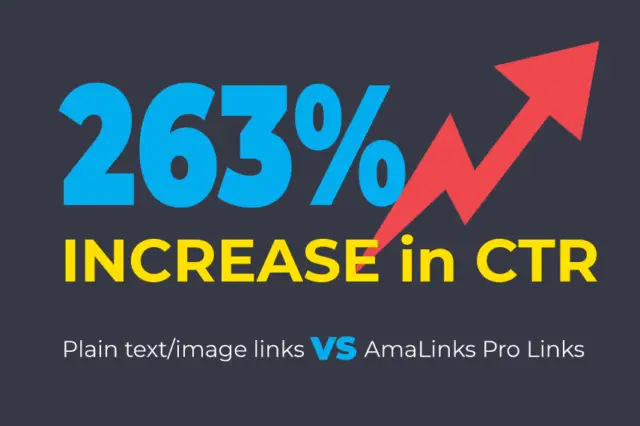

Miles is a loving father of 3 adults, devoted husband of 24+ years, chief affiliate marketer at AmaLinks Pro®, author, entrepreneur, SEO consultant, keynote speaker, investor, & owner of businesses that generate affiliate + ad income (Loop King Laces, Why Stuff Sucks, & Kompelling Kars). He’s spent the past 3 decades growing revenues for other’s businesses as well as his own. Miles has an MBA from Oklahoma State and has been featured in Entrepreneur, the Brookings Institution, Wikipedia, GoDaddy, Search Engine Watch, Advertising Week, & Neil Patel.

Commission Rate & Cookie Information

Barclays Bank offers a commission of $2 Per Sale and their cookie lasts for 45 Days.

For more information about this offer: View the Barclays Bank homepage