Learn About the Capital One Affiliate Program: Rates, Registration, and Other Info

Capital One Financial Corporation was founded in 1988 as a credit card division of Signet Bank. However, it quickly emerged as a trailblazer in the financial industry with its focus on data-driven decision-making and innovative customer offerings. This unique approach led to the introduction of various credit card products that catered to different consumer segments. Capital One’s ability to analyze vast amounts of customer data enabled them to tailor their services to individual needs and preferences, effectively setting the stage for their digital transformation.

With the rise of the internet and the growing reliance on online services, Capital One recognized the potential of establishing a robust online presence. This led to the creation of CapitalOne.com, a platform that would become the cornerstone of their digital strategy. CapitalOne.com was launched as a portal to provide customers with convenient access to their accounts, enabling them to manage their finances, view transactions, make payments, and more from the comfort of their own homes.

Evolution of CapitalOne.com:

As the internet continued to reshape consumer behavior, CapitalOne.com evolved to offer a comprehensive suite of online banking services. This expansion was driven by a commitment to enhancing user experience, streamlining processes, and fostering financial empowerment. Capital One introduced features like online account opening, mobile banking apps, and advanced security measures to safeguard user data and transactions.

A significant turning point for CapitalOne.com was the incorporation of artificial intelligence and machine learning technologies into their services. These technologies enabled the platform to provide personalized insights, predictive analytics, and tailored recommendations based on individual spending patterns. This shift not only demonstrated Capital One’s dedication to staying at the forefront of financial technology but also highlighted their commitment to helping users make informed financial decisions.

Innovations and Features:

CapitalOne.com’s success can be attributed to its relentless pursuit of innovative features and services that cater to the needs of a digital-savvy clientele. One such innovation is “Eno,” an AI-powered virtual assistant that assists customers with various tasks, including tracking spending, managing subscriptions, and monitoring for potential fraudulent activities. Eno’s integration showcases Capital One’s commitment to delivering a seamless and secure digital banking experience.

The platform also offers tools like “CreditWise,” a credit monitoring and management service that provides users with free access to their credit score and insights into factors affecting their credit health. By equipping users with knowledge and tools to manage their credit responsibly, CapitalOne.com contributes to their financial well-being beyond traditional banking services.

Impact and Future:

CapitalOne.com’s journey from an online banking portal to an innovative financial services hub has left an indelible mark on the industry. Its success has underscored the importance of not only adapting to technological advancements but also harnessing them to create value for customers. The platform’s user-friendly interface, AI-driven insights, and comprehensive suite of tools have positioned it as a model for how digital transformation can redefine the relationship between financial institutions and their customers.

CapitalOne.com is likely to continue its trajectory of innovation. As new technologies emerge and customer expectations evolve, the platform will likely integrate features that further empower users to manage their finances effectively and make informed decisions. Enhanced security measures, expanded AI capabilities, and deeper personalization are among the possibilities that may shape the platform’s future.

CapitalOne.com represents a paradigm shift in the banking industry, demonstrating how a forward-thinking financial institution can leverage digital innovation to reimagine the banking experience. From its humble beginnings to its current prominence, the platform’s journey embodies the transformative power of technology in enhancing financial services. By consistently adapting to the changing landscape of modern finance, CapitalOne.com has set a benchmark for the industry and is poised to continue shaping the future of banking through its commitment to digital excellence.

Did you know that Capital One has an affiliate program?

Here is some basic information about what Capital One is all about. Check it out, and if you are interested there is a link below to access the Capital One affiliate program.

Capital One Credit Cards, Bank, and Loans – Personal and Business – Capital One can help you find the right credit cards; checking or savings accounts; auto loans; and other banking services for you or your business

Miles Anthony Smith

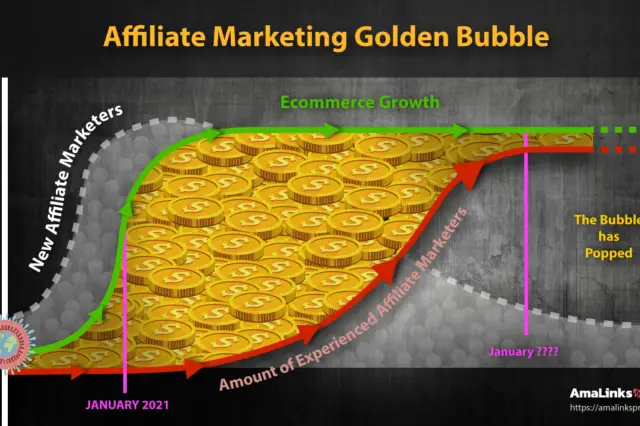

Miles is a loving father of 3 adults, devoted husband of 24+ years, chief affiliate marketer at AmaLinks Pro®, author, entrepreneur, SEO consultant, keynote speaker, investor, & owner of businesses that generate affiliate + ad income (Loop King Laces, Why Stuff Sucks, & Kompelling Kars). He’s spent the past 3 decades growing revenues for other’s businesses as well as his own. Miles has an MBA from Oklahoma State and has been featured in Entrepreneur, the Brookings Institution, Wikipedia, GoDaddy, Search Engine Watch, Advertising Week, & Neil Patel.

For more information about this offer: View the Learn About the Capital One Affiliate Program: Rates, Registration, and Other Info homepage

To sign up for the Learn About the Capital One Affiliate Program: Rates, Registration, and Other Info affiliate program,

follow this link:

Learn About the Capital One Affiliate Program: Rates, Registration, and Other Info affiliate program