Learn about the CrowdStreet affiliate program.

Crowdstreet.com is a real estate crowdfunding platform that allows investors to access a variety of commercial real estate investment opportunities. The platform has become one of the most popular choices for investors looking to invest in real estate without the hassle of managing their own properties. With a user-friendly interface and a range of investment options, Crowdstreet has become a go-to platform for both experienced and novice investors.

Background

Real estate crowdfunding is a relatively new concept that has emerged in recent years. Crowdfunding platforms allow investors to pool their resources and invest in real estate projects that would typically only be available to large institutional investors. The rise of real estate crowdfunding has disrupted the traditional real estate investment industry, opening up new opportunities for individual investors.

Crowdstreet.com was founded in 2013 by Tore Steen and Darren Powderly. Both founders had extensive experience in the commercial real estate industry and saw an opportunity to bring real estate investing to a wider audience. The platform was designed to provide investors with access to high-quality commercial real estate projects, while also streamlining the investment process.

How Crowdstreet Works

Crowdstreet.com is a marketplace that connects investors with real estate sponsors. Sponsors are experienced real estate professionals who are responsible for identifying investment opportunities, acquiring properties, and managing them. The platform offers a range of investment options, including individual investments, joint ventures, and funds.

Investors can browse through a range of investment opportunities on the platform, each with its own detailed investment summary. The investment summaries provide information on the investment opportunity, including the property’s location, the sponsor’s track record, and the expected returns. Investors can also access due diligence materials, including financial statements and property appraisals.

Once investors have selected an investment opportunity, they can invest directly through the platform. The platform provides a streamlined investment process, with all legal and administrative tasks handled online. Investors can also track their investments and monitor their returns through the platform’s dashboard.

Benefits of Crowdstreet

One of the key benefits of Crowdstreet is its accessibility. The platform allows individual investors to access high-quality real estate investment opportunities that would typically only be available to large institutional investors. The platform also provides investors with a range of investment options, from individual investments to funds, allowing investors to diversify their portfolios.

Another benefit of Crowdstreet is its transparency. The platform provides investors with detailed investment summaries and due diligence materials, allowing investors to make informed investment decisions. The platform also requires sponsors to provide regular updates on their projects, allowing investors to monitor their investments in real-time.

Finally, Crowdstreet offers a range of features that make real estate investing more accessible and less complicated. The platform provides a streamlined investment process, with all legal and administrative tasks handled online. The platform also provides investors with a dashboard where they can monitor their investments and track their returns.

Risks of Crowdstreet

While Crowdstreet offers many benefits, it is not without its risks. One of the key risks of real estate crowdfunding is the potential for project failure. Real estate projects are inherently risky, and there is always the possibility that a project may not be successful. If a project fails, investors may lose some or all of their investment.

Another risk of Crowdstreet is the potential for fraud. While Crowdstreet has implemented a range of measures to prevent fraud, there is always the potential for bad actors to use the platform to defraud investors. Investors should always conduct their due diligence and carefully evaluate investment opportunities before investing.

Finally, real estate investments are illiquid, meaning that investors may not be able to sell their investments quickly. While Crowdstreet does offer a secondary market where investors can sell their investments, liquidity is not guaranteed.

Did you know that CrowdStreet has an affiliate program?

Here is some basic information about what CrowdStreet is all about. Check it out, and if you are interested there is a link below to access the CrowdStreet affiliate program.

CrowdStreet: Online Commercial Real Estate Investing Platform – Diversify your portfolio with commercial real estate investments on the CrowdStreet platform. Start building wealth today.

Miles Anthony Smith

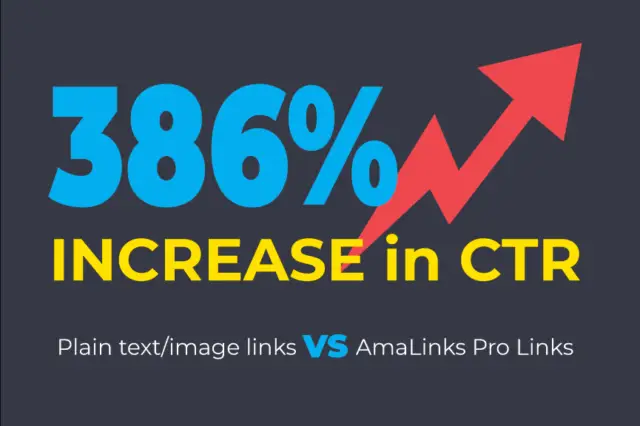

Miles is a loving father of 3 adults, devoted husband of 24+ years, chief affiliate marketer at AmaLinks Pro®, author, entrepreneur, SEO consultant, keynote speaker, investor, & owner of businesses that generate affiliate + ad income (Loop King Laces, Why Stuff Sucks, & Kompelling Kars). He’s spent the past 3 decades growing revenues for other’s businesses as well as his own. Miles has an MBA from Oklahoma State and has been featured in Entrepreneur, the Brookings Institution, Wikipedia, GoDaddy, Search Engine Watch, Advertising Week, & Neil Patel.

For more information about this offer: View the CrowdStreet homepage