Learn about the Trim affiliate program.

In today’s fast-paced world, managing personal finances has become increasingly complex. Balancing budgets, paying bills, saving for the future, and optimizing expenses can be overwhelming tasks, often requiring hours of meticulous tracking and decision-making. Fortunately, technology has stepped in to streamline this process, making financial management more accessible and efficient for everyone. AskTrim.com is one such platform that has emerged to simplify the financial lives of its users. In this article, we will delve into the specifics of AskTrim.com, exploring its origins, features, and how it has revolutionized personal finance management.

AskTrim.com, launched in 2015, is a financial technology company that offers a comprehensive suite of tools and services to help individuals take control of their finances. Founded by Thomas Smyth and Daniel Petkevich, AskTrim.com emerged as a response to the growing need for accessible and user-friendly financial management solutions.

At its core, AskTrim.com is designed to empower users with insights and tools that enable them to make informed financial decisions. It accomplishes this through a combination of cutting-edge technology, data analysis, and a user-friendly interface. Over the years, it has gained popularity and trust among a diverse user base, from young professionals looking to save money to families striving to budget more effectively.

Features and Functions

- Expense Tracking and Analysis: AskTrim.com simplifies expense tracking by aggregating and categorizing your spending habits. Users can link their bank accounts and credit cards to the platform, allowing it to automatically analyze transactions. This feature provides a clear overview of where money is going, making it easier to identify areas where cost-cutting is possible.

- Bill Negotiation: One of the standout features of AskTrim.com is its bill negotiation service. The platform’s algorithms scan your recurring bills, such as cable, internet, and subscription services, and automatically negotiate with providers to lower your monthly costs. Users can save significant amounts of money with minimal effort, thanks to this innovative feature.

- Budgeting Tools: AskTrim.com offers comprehensive budgeting tools that allow users to set financial goals, create budgets, and track their progress. The platform provides personalized recommendations based on spending habits and financial goals, helping users make informed decisions to meet their targets.

- Savings Advice: With a focus on financial wellness, AskTrim.com provides personalized savings advice. The platform evaluates your financial situation and recommends strategies to maximize savings, whether it’s setting up an emergency fund, contributing to retirement accounts, or investing wisely.

- Investment Guidance: For those interested in growing their wealth through investments, AskTrim.com offers guidance on investment options and strategies. While not a full-fledged investment platform, it provides valuable insights and recommendations to help users make informed choices.

- Mobile Accessibility: AskTrim.com recognizes the importance of accessibility in modern financial management. Its mobile app allows users to manage their finances on the go, ensuring that you can stay in control of your money wherever you are.

User Benefits

AskTrim.com has garnered a loyal user base by delivering tangible benefits to its customers:

- Time Savings: The platform automates many tedious financial tasks, saving users time and effort.

- Cost Reduction: Through bill negotiation and expense tracking, AskTrim.com helps users lower their recurring expenses, putting more money back into their pockets.

- Financial Education: The platform’s budgeting tools and savings advice offer valuable financial education, helping users make informed decisions about their money.

- Peace of Mind: By providing insights into financial health and helping users build better financial habits, AskTrim.com contributes to reduced financial stress.

Security is paramount when dealing with personal financial data. AskTrim.com takes this seriously by employing robust encryption protocols and adhering to industry-standard security practices. User data is anonymized and securely stored, ensuring that sensitive information remains confidential.

AskTrim.com has emerged as a powerful tool in the realm of personal finance management. With its commitment to simplifying financial tasks, reducing costs, and offering valuable insights, it has earned the trust of users seeking to regain control of their financial lives. By leveraging technology and data analysis, AskTrim.com provides an objective and unbiased approach to managing finances, making it a valuable resource for individuals of all financial backgrounds. Whether you are looking to cut expenses, save for the future, or invest wisely, AskTrim.com offers a user-friendly platform to help you achieve your financial goals with clarity and confidence.

Did you know that Trim has an affiliate program?

Here is some basic information about what Trim is all about. Check it out, and if you are interested there is a link below to access the Trim affiliate program.

Trim, Save Money Automagically – Trim | An Assistant That Saves You Money

Miles Anthony Smith

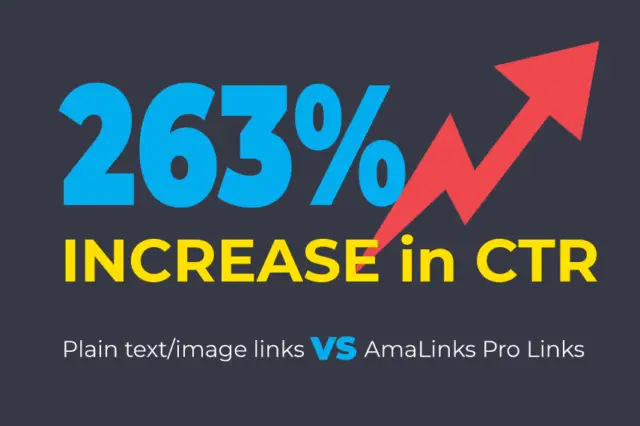

Miles is a loving father of 3 adults, devoted husband of 24+ years, chief affiliate marketer at AmaLinks Pro®, author, entrepreneur, SEO consultant, keynote speaker, investor, & owner of businesses that generate affiliate + ad income (Loop King Laces, Why Stuff Sucks, & Kompelling Kars). He’s spent the past 3 decades growing revenues for other’s businesses as well as his own. Miles has an MBA from Oklahoma State and has been featured in Entrepreneur, the Brookings Institution, Wikipedia, GoDaddy, Search Engine Watch, Advertising Week, & Neil Patel.

Commission Rate & Cookie Information

Trim offers a commission of $6 Per Lead and their cookie lasts for 30 Days.

For more information about this offer: View the Trim homepage