Learn about the TurboTax affiliate program.

TurboTax, accessible via its primary online domain ‘turbotax.intuit.com’, is a tax preparation software developed and marketed by Intuit Inc. The software is designed to guide individual users, small businesses, and professionals through the process of filing their federal and state income taxes. Offered in both online and desktop versions, TurboTax is recognized for its user-friendly interface, step-by-step guidance, and the ability to handle complex tax scenarios.

Background:

1. Intuit Inc. and its Evolution:

Intuit Inc., the company behind TurboTax, was founded in 1984 by Scott Cook and Tom Proulx in Palo Alto, California. Originally, the company gained traction with its financial software, Quicken. Recognizing the potential for tax software, Intuit launched TurboTax in the late 1980s. Since its inception, Intuit has evolved into a global financial software company, offering a range of products in personal finance, small business accounting, and tax preparation.

2. Evolution of TurboTax:

TurboTax started as a DOS-based application and was one of the early pioneers in personal tax preparation software. Its intuitive design was built on the premise of making the cumbersome tax filing process more manageable for the average person.

In the mid-1990s, TurboTax transitioned to the Windows platform, and its popularity surged. With the rise of the internet in the late 1990s and early 2000s, TurboTax introduced its online version, enabling users to complete their tax returns without installing any software on their computers. This online platform, available at ‘turbotax.intuit.com’, provided users with automatic updates relevant to the latest tax laws and offered various versions tailored to different tax needs.

3. TurboTax Versions:

TurboTax offers multiple versions designed to cater to various user needs:

- TurboTax Free Edition: Suitable for simple tax returns, this version caters to individuals who have straightforward financial situations, such as single filers with no deductions or credits.

- TurboTax Deluxe: Geared towards maximizing deductions and credits, it’s a fit for those who itemize their returns.

- TurboTax Premier: This version is tailored for those with investments and rental properties.

- TurboTax Self-Employed: Designed for freelancers, independent contractors, and small business owners, this edition addresses specific needs like business income and expenses.

- TurboTax Live: A newer offering, TurboTax Live, connects users with certified tax professionals who can provide real-time advice or review completed returns.

4. Features and Benefits:

- User Experience: TurboTax is known for its interactive interface that uses a Q&A format, guiding users by asking them simple questions and automatically filling in forms based on their responses.

- Data Import: The software allows for importing financial data from a variety of sources, reducing manual entry and potential errors.

- Accuracy Checks: TurboTax runs numerous accuracy checks and guarantees accurate calculations, offering to pay penalties and interest if a user incurs an IRS penalty due to a TurboTax calculation error.

- Up-to-Date with Tax Laws: The software regularly updates to reflect the latest federal and state tax laws, ensuring that users always have access to current information.

5. Controversies and Challenges:

While TurboTax is widely respected for its utility, it has not been without controversy. Over the years, the company faced scrutiny and criticism, particularly regarding its lobbying efforts. Some have argued that such efforts aimed at making tax codes more complex, thereby making taxpayers more reliant on software like TurboTax. Furthermore, there were instances where features users had previously accessed for free were moved to paid versions, leading to customer dissatisfaction.

6. TurboTax and the Broader Ecosystem:

TurboTax’s integration doesn’t end with personal tax filing. Intuit’s broader ecosystem includes tools like QuickBooks (an accounting software for businesses) and Mint (a personal finance tool). Such integration provides a seamless experience for users who may use multiple Intuit products, further solidifying the company’s position in the financial software market.

TurboTax, accessible through ‘turbotax.intuit.com’, represents one of the modern digital tools simplifying what was once a tedious and complicated task—tax preparation. Its rich history and evolution alongside technological advancements have made it an indispensable tool for millions of taxpayers. Like any significant product, it has its champions and detractors, but there’s no denying its profound impact on personal and business tax filing processes in the digital age.

Did you know that TurboTax has an affiliate program?

Here is some basic information about what TurboTax is all about. Check it out, and if you are interested there is a link below to access the TurboTax affiliate program.

TurboTax® Official Site: File Taxes Online, Tax Filing Made Easy – TurboTax® is the #1 best-selling tax preparation software to file taxes online. Easily file federal and state income tax returns with 100% accuracy to get your maximum tax refund guaranteed. Start for free today and join the millions who file with TurboTax.

Miles Anthony Smith

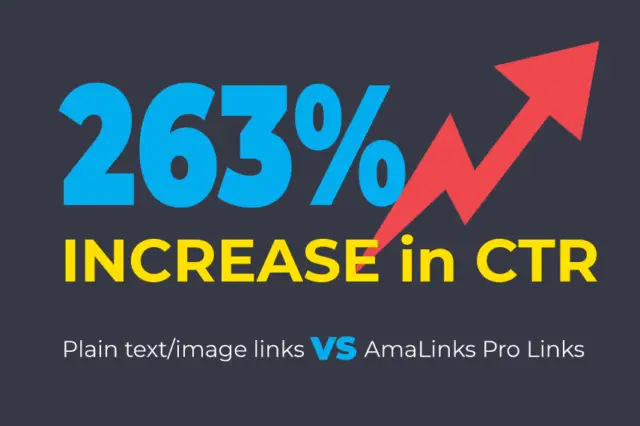

Miles is a loving father of 3 adults, devoted husband of 24+ years, chief affiliate marketer at AmaLinks Pro®, author, entrepreneur, SEO consultant, keynote speaker, investor, & owner of businesses that generate affiliate + ad income (Loop King Laces, Why Stuff Sucks, & Kompelling Kars). He’s spent the past 3 decades growing revenues for other’s businesses as well as his own. Miles has an MBA from Oklahoma State and has been featured in Entrepreneur, the Brookings Institution, Wikipedia, GoDaddy, Search Engine Watch, Advertising Week, & Neil Patel.

Commission Rate & Cookie Information

TurboTax offers a commission of 15% Per Sale and their cookie lasts for 21 Days.

For more information about this offer: View the TurboTax homepage